The consulting visibility problem

You know what you spend. But do you know what you're getting?

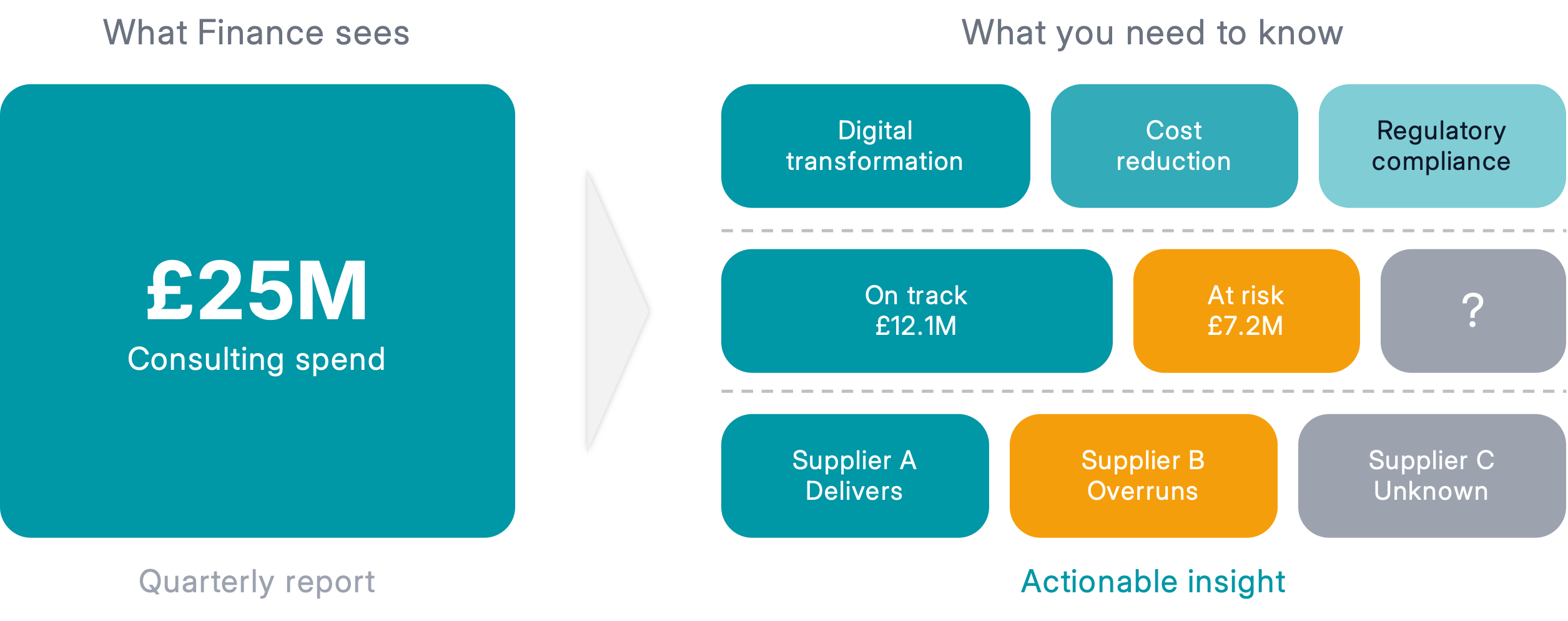

Most finance teams can tell you roughly what the company spent on consultants last year. The number sits in a quarterly report somewhere, probably labelled "professional services" or "advisory fees."

But ask a different question - which initiatives is that money supporting? Which engagements are on track? Which suppliers are delivering value? - and the picture gets murkier.

This is the real consulting visibility problem. It's not that the total is unknown. It's that the total doesn't tell you anything useful.

What the numbers don't show

A quarterly spend report might tell you that £25m went to consulting firms. It won't tell you:

- Which strategic priorities that money supported: How much went to the digital transformation vs. the cost reduction programme vs. regulatory compliance?

- Whether engagements are on track: Is the ERP implementation progressing as planned, or quietly overrunning?

- What you're actually getting: Are you paying for senior consultants but getting junior delivery?

- Which suppliers perform: Which firms consistently deliver on time and within scope, which tend to experience delays or overruns?

McKinsey's research on indirect procurement highlights this challenge: spending is "often fragmented among multiple locations, business units, and categories, making it hard to identify and capture enterprise-wide savings opportunities."

Where the complexity comes from

Several factors make consulting harder to track than other spend categories:

Decentralised buying: Finance, IT, Operations, and business units all bring in their own consultants. Each thinks they know what they're spending. Nobody has the full picture.

Blurred categories: The line between "consulting" and "contractors" is fuzzy, especially in IT. A systems integrator might show up in consulting budgets, contractor budgets, or project budgets depending on how it was procured. One major retailer found hundreds of IT consultants - mostly independents and small teams via agencies - coded as "contractors" or "application services" rather than consulting. They only appeared when someone looked at the invoices properly.

Non-discretionary spend: Not all consulting is optional. Regulatory programmes, compliance reviews, and audit support have to happen. You can't just "cut" them, but you still need to know if you're getting value.

Tail spend accumulation: Large transformation programmes get attention. But dozens of smaller engagements - £30k here, £50k there - fly under the radar. Individually they seem minor. Collectively they add up to millions. A utility provider found a long tail of small engineering engagements with no central approval or scoping methodology - and multiple consultancies investigating the same questions with overlapping scope.

What good visibility actually looks like

Full visibility isn't just knowing the total. It's being able to answer:

- What's every active consulting engagement across the business right now?

- How does spend break down by strategic priority, not just by supplier?

- Which engagements are progressing as planned, and which need attention?

- How do our rates compare across similar engagements?

- Which suppliers have the best track record of delivering on time and on budget?

The challenge is getting there without creating a reporting burden that costs more than it saves.

How Scopecreeper approaches this

We start with the data that already exists: invoices and statements of work.

Every consulting engagement generates these documents whether you track them or not. They contain the information you need - who's working on what, at what rates, against what milestones, for how much. The problem is that it's locked in PDFs and scattered across inboxes.

Scopecreeper uses AI to read these documents and build a structured picture of every engagement. Invoices are automatically grouped by engagement. Milestones and budgets are extracted from SOWs. Spend is tracked against progress.

The result: visibility that connects spend to outcomes, built from data you already have, without manual data entry.